During our time in Quant Finance, regression wringer was often the weightier tool we had for determining the effectiveness of factors and models. We at SFS, we were expressly well-appointed performing regressions when the relationship between our variables was unmistakably linear, our datasets weren’t too big, and we wanted results that were simple to explain.

Machine Learning is now all the rage and its the largest nomination in some situations.

Scalability: ML algorithms can be scaled up to handle both ramified problems and large datasets.

Non-linearity: Regression wringer assumes a linear relationship between the self-sustaining and dependent variables. In contrast, ML algorithms are very good at dealing with non-linear relationships between variables and discovering less obvious, ramified relationships. ML algorithms tend to be increasingly robust to correlated, similar information conditions.

High Dimensionality: Machine learning techniques excel at upper dimensional problems where there are many informational features to consider. Upper dimension problems can overwhelm qualitative, subjective methods particularly in the presence of novel features (new information sets) for which analysts have little wits and conventional wisdom to yank upon.

Flexibility: Along with handling large and ramified datasets, ML can be used for both supervised and unsupervised learning, and can be trained to snift patterns and relationships that are moreover not so obvious from looking at the data with traditional tools.

Accuracy: Machine learning models often outperform regression wringer in terms of prediction accuracy, expressly when dealing with ramified or high-dimensional datasets.

In summary, Machine Learning techniques provide quant stock pickers with a powerful set of tools to unriddle and predict stock performance. By leveraging these technologies, quant stock pickers can make increasingly informed investment decisions in a faster and increasingly efficient manner.

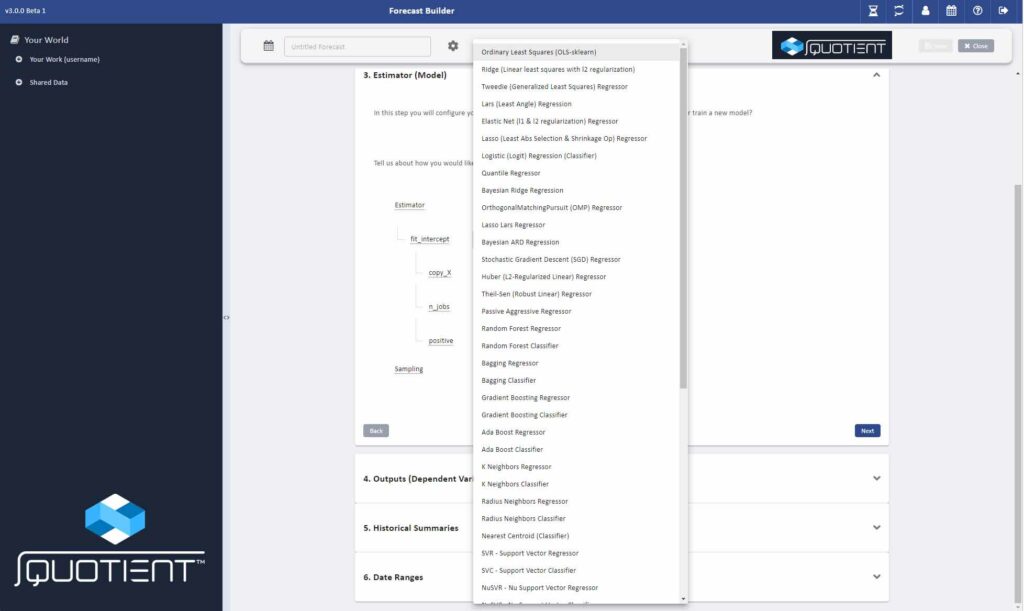

To help quants take wholesomeness of this trend, SFS Quotient Powered by Snowflake has integrated over *50* Machine Learning algorithms into their powerful Forecaster module. Users can hands enter all the characteristics for algorithms and run them versus their proprietary models.

Machine Learning models indulge us to see remoter into the datas underlying relationships than traditional techniques. Looking vastitude the domain of traditional methods is where the weightier investment opportunities are found particularly for the early adopters. We will discuss this first mover advantage of Machine Learning in increasingly detail in our next blog.

Watch a unenduring overview of Quotient

For increasingly information onSFS Quotient Powered by Snowflake and to schedule a demo, pleasefill out a request formor email us atinfo@scifinsys.com